Debt Service Ratio Malaysia 2019

If you plan to buy a property one of the important factors that will affect the amount you can borrow is tdsr.

Debt service ratio malaysia 2019. Find out about tdsr rules and calculation. The total debt servicing ratio tdsr is a regulation introduced by the singapore government in 2013 to ensure singaporeans borrow responsibly and reduce systemic risk of being over leveraged. Bank negara malaysia bnm. A borrower s tdsr should be less than or equal to 60.

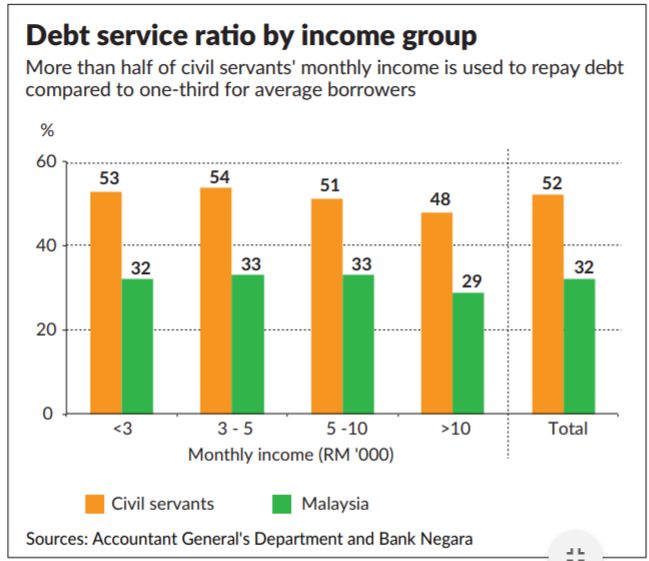

Debt service ratio dsr calculator from this ratio it can help you to recognize either you are in a healthy financial position or unhealthy financial position. As her monthly commitment is over 50 she may find it challenging to get approved for loan even with a guarantor. This page provides malaysia government debt to gdp actual values historical data forecast chart. Total debt servicing ratio tdsr refers to the portion of a borrower s gross monthly income that goes towards repaying the monthly debt obligations including the loan being applied for.

Malaysia recorded a government debt equivalent to 51 80 percent of the country s gross domestic product in 2018. With an income of rm7 000 monthly and a monthly commitment of rm4 000 joanne has a debt ratio of 57 14. Effective 1 october 2019. Her debt service ratio would be calculated as.

The dsr is meant to show how much of a person s income is used to service debt instalments and is represented as a percentage of income. It is derived from 2 main components. Rm4 000 rm7 000 x 100 57 14.