Rental Income Tax Malaysia Public Ruling

Income from letting of real property.

Rental income tax malaysia public ruling. The inland revenue board irb has issued public ruling no. Objective this public ruling pr explains. 11 2018 on 5 december 2018 which supersedes the previous guidance on nonresident withholding tax on special classes of income pr no. Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms.

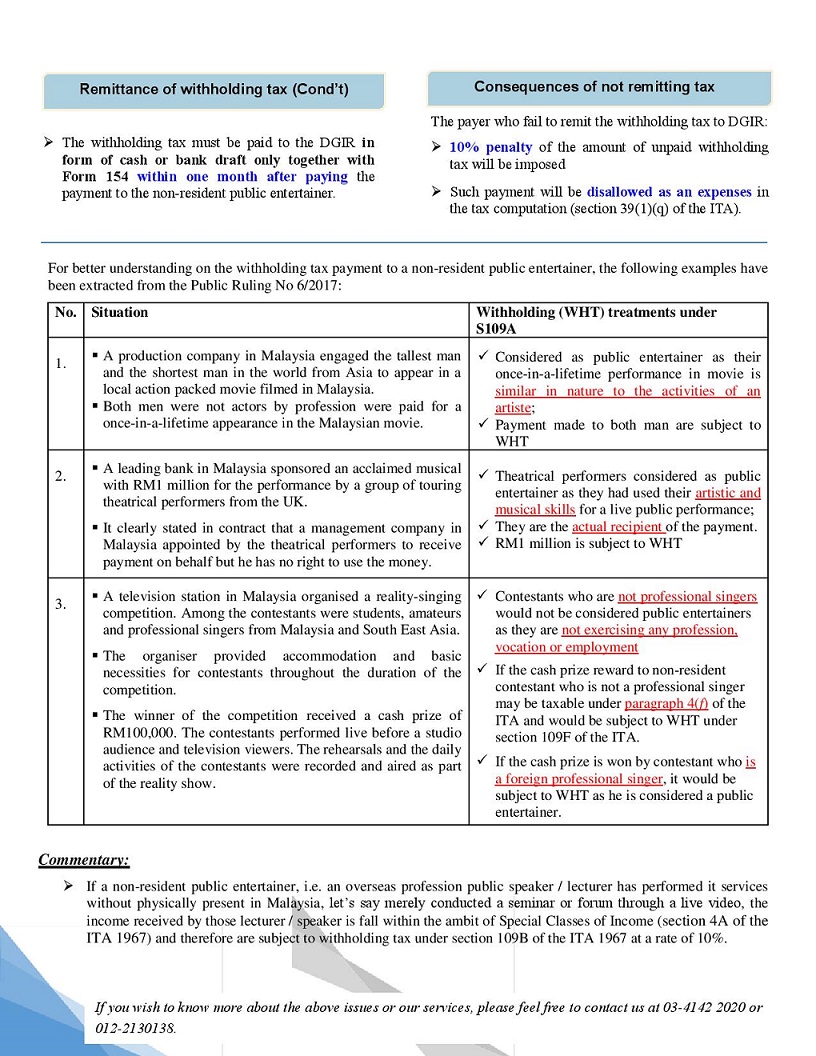

Types of income rate public entertainer s professional income 15 interest 15 royalty 10 special classes of income. The inland revenue board irb of malaysia issued public ruling pr no. 1 2004 issued on 30 june 2004 provides clarification on. Director general s public ruling section 138a of the income tax act 1967 ita provides that the director general is empowered to make a public ruling in relation to the application of any provisions of the ita.

This pr which supersedes pr no. A letting of real property as a business source under paragraph 4 a of the income tax act 1967 ita. And b letting of real property as a non business source under paragraph 4 d of the ita. Individuals need to.

1 2014 last amended on 27 june 2018. A public ruling is published as a guide for the public and officers of the inland revenue board of malaysia. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. I letting of real property as a business source under paragraph 4 a of the income tax act 1967 ita.

The definition of employment income covers all forms of remuneration including benefits whether in cash or in kind received by an individual for exercising or having an employment in malaysia 14 therefore an employee s income with respect to their employment in malaysia will be subject to malaysian tax regardless of whether it is paid in malaysia or outside malaysia. 19 december 2018 1. In budget 2018 the government introduced a new limited time tax exemption designed to control home rental prices. Income tax in malaysia is imposed on income.

12 2018 inland revenue board of malaysia date of publication. Rental of moveable property technical or management services fees payment for services rendered in connection with use of property. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. The idea is that income from the renting of residential properties would receive a 50 exemption from income tax.